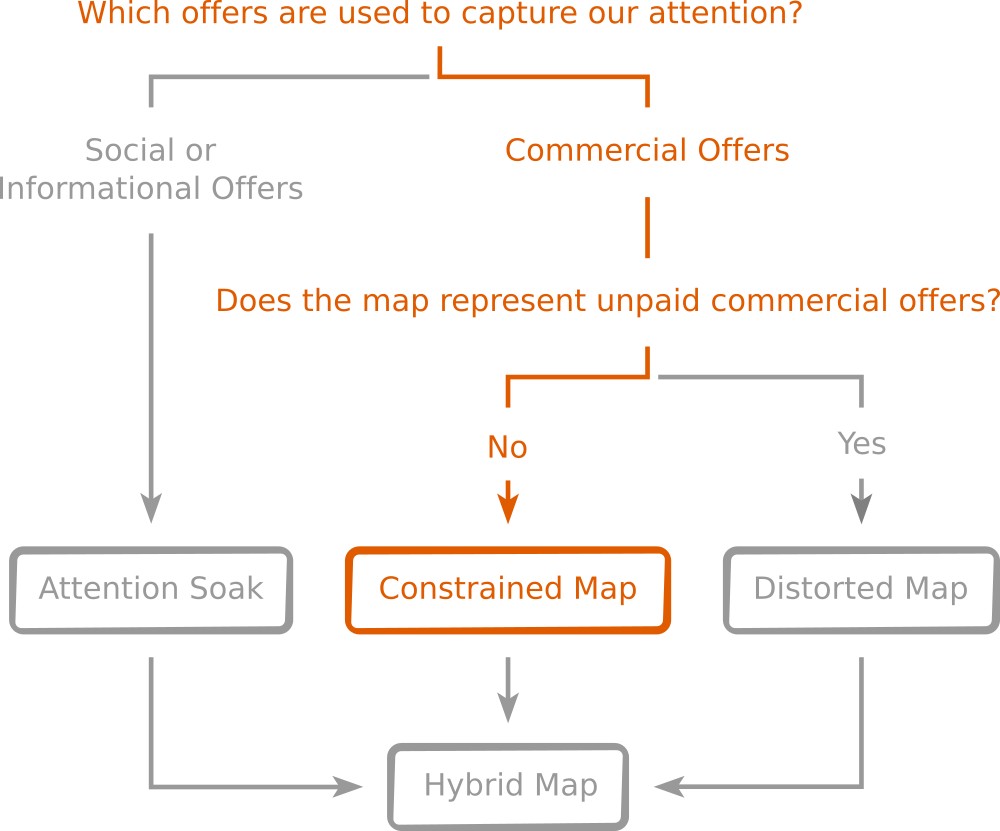

Constrained maps capture our attention to commercial offers and sell our attention by excluding unpaid commercial offers. These maps have several perverse incentives and lie to us about the offers which are best for us.

Paid commercial offers

Constrained maps are those which represent only paid commercial offers but exclude all unpaid commercial offers:

Examples include Amazon, eBay, Google Shopping, Uber, newspaper classifieds, Wal-Mart, shopping malls and supermarkets[1].

Unlike attention soaks (where the paid commercial offers are a distraction from our goal of receiving social and informational offers) we use constrained maps to receive commercial offers as quickly and easily as possible.

How attention is captured

Constrained maps capture our attention by minimizing our attention costs as we process their map – by making it easier, faster, simpler and safer to receive and accept a wide range of commercial offers.

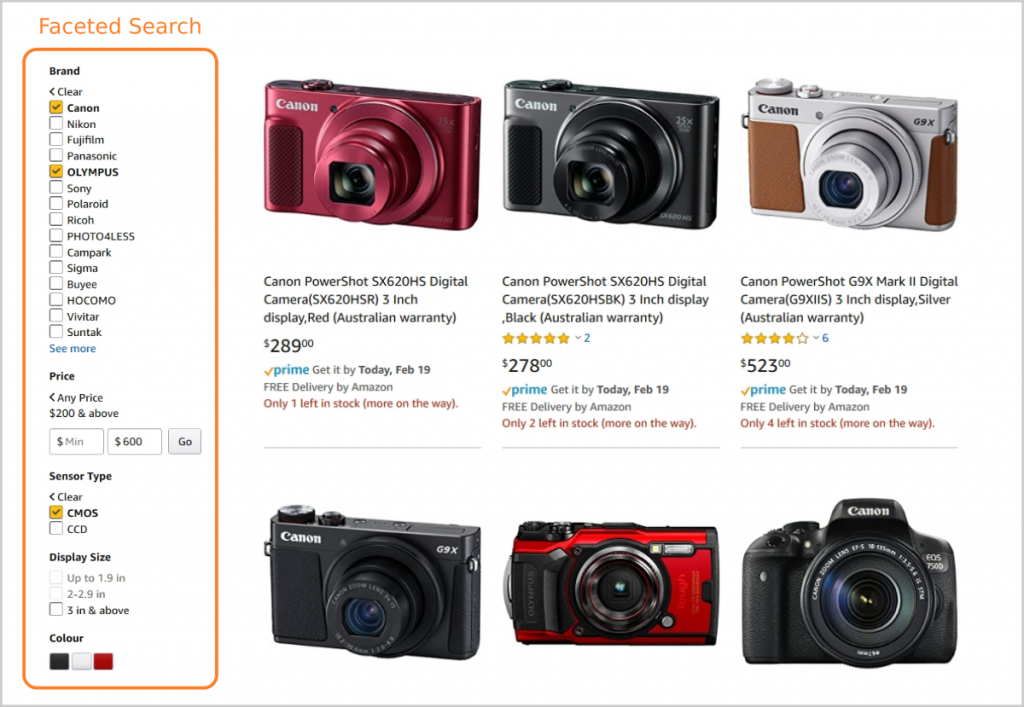

One important strategy used by online constrained maps is faceted search. It allows us to specify our criteria for offers so that the aggregator uses their processing power to filter out the irrelevant offers (and, therefore, we conserve our attention for the relevant offers):

Most constrained maps (Amazon, supermarkets, Wal-Mart, etc.) also attract our attention by minimizing our financial costs in using their map (by being the cheapest supplier of goods and services).

The ultimate goal for constrained maps, of course, is to become our default destination for purchasing one or more types of offers.

How attention is sold

Attention is sold by excluding all unpaid offers from the map, such that offering parties are forced to pay the aggregator (if they want to trade with the receiving parties captured by the aggregator’s map):

In other words, constrained maps do not allow us to find all of the commercial offers which meet our criteria, only the subset of those which pay the aggregator. There is, therefore, a hidden and self-serving criterion set by the aggregator for all offers displayed on the map: ‘offers from parties which pay us’. [2]

Note that there are several different methods of extracting this payment:

- classifieds require an upfront fee to have offers represented on the map,

- shopping malls require that retailers (the offering parties) to pay rent in advance,

- Google Shopping charges offering parties when their offers are clicked on, or

- Amazon handles the entire transaction and retains their fee.

Compared to an attention soak (which is trying to take a large fee by representing a relatively small number of commercial offers), constrained maps are trying to take a relatively small fee on a every commercial offer. Or, to be more accurate, constrained maps are trying to take the largest possible fee from offering parties, but the goal of capturing every commercial offer requires that the fee is initially small (or they will fail to capture offers and, therefore, the attention of receiving parties to their maps). As constrained maps capture more attention, however, the aggregator gains monopsony power through which it can force offering parties to pay higher fees and to bear the aggregators’ costs and risks.

Perverse incentives

A constrained map’s focus on making it easier, faster, simpler and/or cheaper to receive offers feels like an alignment of goals between the aggregator and receiving parties (the ‘consumers’ that these maps are supposedly serving)[3].

Aggregators generating constrained maps, however, have incentive to:

- capture commercial offers exclusively to their map (so that these products and services cannot be found on competing maps),

- create their own products which compete with vendors’,

- efficiency at the expense of diversity,

- overwork and underpay workers

- add layers of distortion (to become hybrid maps)

- homogeneity – represent only the largest offering parties (for the sake of effiency)

The lie which constrained maps tell

The lie which constrained maps tell about our economic territory is that:

The offers which do not make money for the aggregator do not exist.

At first glance, this lie seems entirely reasonable. The aggregator has to make money, so why would anyone expect them to represent unpaid offers alongside paid offers? The problem is that the constrained map strategy damages our markets through fragmentation and exclusion.

Fragmentation occurs because offering parties cannot afford to pay every aggregator to appear on their map. Where multiple constrained maps compete for receiving party attention, therefore, each of those maps will exclude the offers of many offering parties, even though those offering parties might be paying other aggregators to appear on their maps. In this case no single map provides access to the entire market of offers – each aggregator is creating their own silo.

We might expect, therefore, that the solution for this fragmentation is for there to be a single constrained map that every offering and receiving party wants to use. In this case, however, the aggregator’s monopoly over receiving party attention allows them to maximize profits by setting high prices (or setting unfavorable trading terms) that many offering parties cannot bear. And as we’ll see when we discuss the big problems caused by aggregators, excluding poorer offering parties from trade today is a sure-fire method of excluding them from trade in perpetuity.

There is more at stake, therefore, than ensuring that aggregators can make money. The lie of constrained maps is serious, and the more popular a map becomes, the more dangerous the lie becomes. Amazon, for instance, is not the everything store – it’s the everything that makes money for Amazon and nothing that doesn’t store. When hundreds of millions of people use Amazon’s map to navigate the economy, that’s a very significant difference.

Footnotes:

1. Supermarkets sell Fast-Moving Consumer Goods which sell every 25 days (an average of 14.5 times per year) but the supermarket pays the manufacturer or wholesaler of the goods on 45, 90 or even 120 day payment terms. As such the supermarket isn’t in the ‘buy and sell products’ business (which would make them a vendor), they’re in the ‘borrow products from vendors to capture consumer attention and money’ business (which makes them an aggregator).

2. It’s worth noting that an offering party’s ability to pay the aggregator is a useful signal of their capability and trustworthiness in the presence of information asymmetry. The aggreagators’ use of this particular filter / heuristic is, however, self-serving and problematic because it fosters inequality – the vendors who can pay enter a virtuous cycle in which they receive more trade and profit (and the vendors who can’t pay don’t). There are many other filters and heuristics which could be used as signals of quality – we must use a diverse array of them to foster a broad distribution of opportunity across offering parties.

3. This is, for instance, why Amazon is regarded as the best company in America.