Aggregators are not acting as free markets – they’re competing with us to take our money, efficiency and opportunities by either inducing a producer surplus (and taking it), or inducing a consumer surplus (and taking vendor’s efficiency and opportunities).

Free Markets

Free markets allow people to trade freely, by which we mean that:

- no one is forced to trade, and

- prices are an outcome of supply and demand in the market.

It’s worth noting here that a ‘market’ is simply a set of choices. In a free market, buyers have free choice of vendors and vendors have free choice of buyers. Two important factors in that choice are price and value, which are brought together in the concept of a surplus. We’ll look at this concept to understand how aggregators take money and efficiency from us.

Surplus

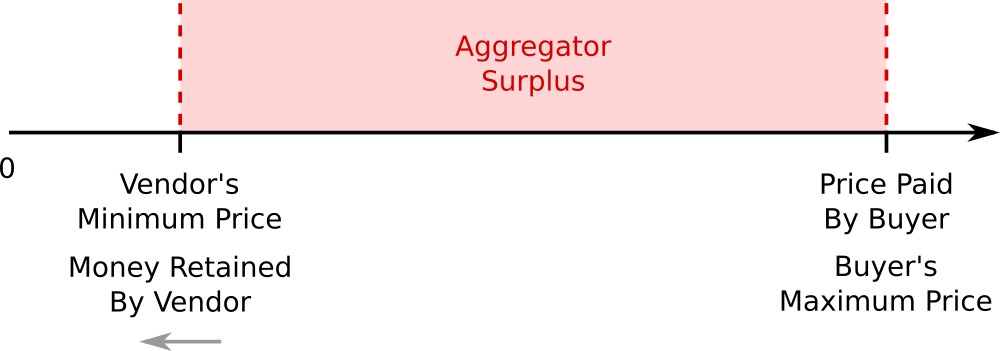

Let’s look at a single trade in a free market – the sale of one product from one vendor to one buyer:

There are few things going on here and it’s worth understanding what they are. If you happen to know what supply and demand curves are, the above represents a slice of those curves for a particular quantity and then rotated 90 degrees.

In the above graph there is only one axis and it shows a range of prices, with 0 on the left and upwards to the right.

In the middle we see the price paid by the buyer to the vendor for the product that was sold. Because the buyer and the vendor are the only people involved in this transaction, the vendor retains all of that money.

On the left is the vendor’s minimum price. We don’t care what the actual number is – the important thing to note here is that it is lower than the price actually paid by the buyer. This means that the vendor received some surplus money from trade – they were very happy because they got more money than they were prepared to accept. Economists call this a producer surplus, but we’ll call it a vendor surplus here to have consistency in our terms.

On the right is the buyer’s maximum price. This is the value that this buyer placed on the product when they were buying it. As you can see, they paid less than the maximum price they were prepared to pay, so they also received surplus money (they were very happy to have additional money left in their pocket). Economists call this a consumer surplus, but we’ll call it a buyer surplus here.

Finally, the total of the vendor surplus and the buyer surplus equals the economic surplus. It’s the total monetary gain which was created by the this trade (and it’s the additional value that vendors and buyers sometimes fight over by haggling on the price).

Efficiency & Monopoly

Not all trades have a surplus. The magic of free markets is that they can reach an equilibrium in which buyers and vendors in the market have responded to the price of goods to produce the optimal quantity of goods. At equilibrium, the marginal (last) trade in the market has no economic surplus at all:

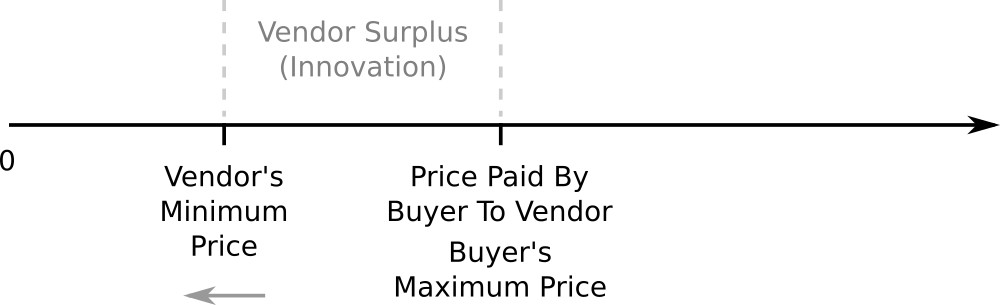

Obviously vendors would prefer to create a vendor surplus if they can. They can often do this by innovating so that they can become more efficient. This increased efficiency allows them to reduce their costs and make a surplus even when selling at the equilibrium price (which is set by competing vendors who are less efficient and, therefore, have higher costs):

The challenge for innovative vendors is that their competitors will imitate their innovations (or come up with different ones), increase their efficiency and lower their prices to compete, eating away at vendor surpluses. This is bad for individual vendors but is utterly brilliant for buyers (who receive a buyer surplus). This incentive for vendors to increase their efficiency is reason that the price of food, technology and other goods has fallen over time in market economies.

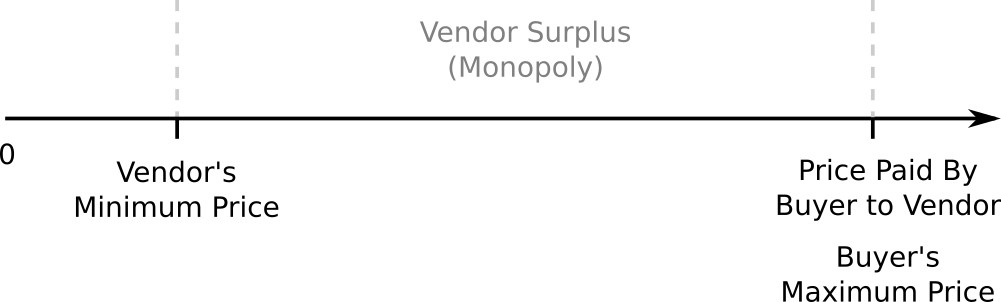

It’s also why vendors would prefer to obtain a monopoly if they can – a market in which they’re the only seller and, therefore, have no competition from other vendors. Without that competition they can limit the quantity they sell to a smaller set of buyers who place a higher value on their goods. They can then raise their prices to the maximum price that the last of those buyers is willing to pay. This allows the vendor to take an enormous vendor surplus for themselves at the expense of buyers:

Now we’ve looked at free markets, efficiency and monopolies, we’re ready to understand what aggregators are doing.

The Aggregator Surplus

As we saw previously, aggregators are not vendors – they’re middlemen who run two-sided marketplaces. Aggregators sell the attention of buyers (on one side of the marketplace) to the vendors (on the other side of the marketplace) by manipulating the set of offers shown to buyers.

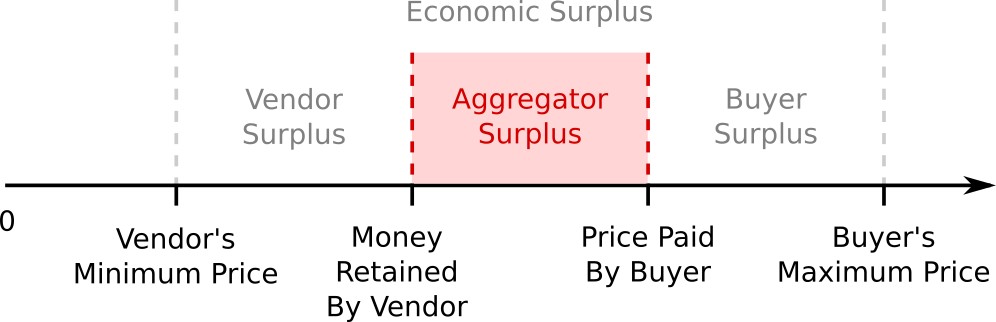

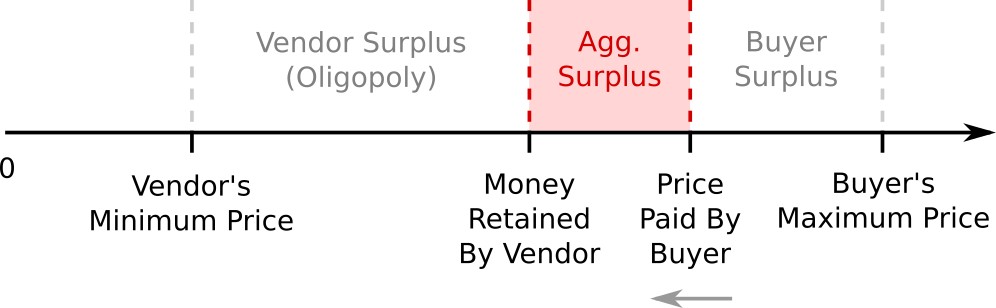

This means that there are actually three different parties vying for the economic surplus:

The aggregator takes a share of the economic surplus when:

- the aggregator (e.g. a supermarket) receives the money from the buyer and passes a lower amount on to the vendor, or

- the vendor pays the aggregator a fee to be represented on their map (in which case the money retained by the vendor, shown on the above graph, is equivalent to the price paid by the buyer minus the fee paid to the aggregator).

Given that the aggregator is a profit-maximizing corporation, however, its shareholders aren’t actually interested in ‘sharing’ the surplus with buyers and vendors – they’d prefer to take all of the economic surplus from all of the trades which are enabled by their map:

More than that, they’d like to funnel our entire economy through their map (so that they can take the full economic surplus on every trade in the entire economy).

When aggregators are new and powerless, however, they can’t force us to use their map. Instead, they invite us to use their map by making a deceptive promise:

Free Surplus!

Free Surplus!

Everyone wants a free surplus, to make more money in their trade than they were expecting.

Aggregators have two distinct methods of giving us that free surplus (and then taking back as much as they can). They either:

- increase the vendor surplus (and take it), or

- increase the consumer surplus (and take vendors’ efficiency).

1. Increasing the vendor surplus (and taking it)

Earlier I showed you a graph which represented the vendors who make little or no vendor surplus (because they’re not innovative or their innovation advantage has been competed away):

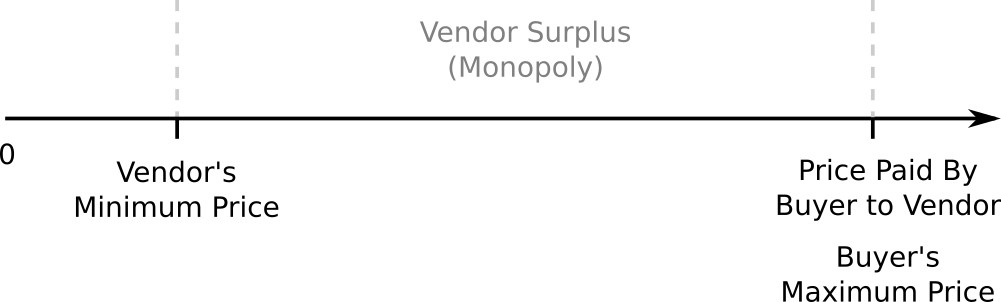

I also showed you a graph of a monopoly, in which the vendor takes the maximum possible economic surplus (at buyers’ expense):

Some aggregators, therefore, allow vendors (who have no competitive advantage and therefore no vendor surplus) to buy a temporary monopoly (to artificially induce a vendor surplus). Aggregators do this by minimizing competition for those vendors’ offers when they’re represented on the map to buyers. All the vendor has to do is pay a fee to the aggregator and then they can raise their prices to obtain a vendor surplus. This is, effectively, free money to the vendor (because they have a positive return on their investment):

We call this advertising.

Consider a television or newspaper ad. Each advertisement represents only one offer and its represented to you without competition of any kind. An ad for phone plan, say, doesn’t also suggest an competitor’s plan that you should consider – it presents the phone plan to you as though it’s the only phone plan in the world. This allows the provider to charge a premium (a vendor surplus) for the plan and, in return, gives them an incentive to pay the television channel or newspaper to obtain that premium.

Or consider Google’s Search Engine Results Page (SERP). At the top there are few ads (offers) which stand out from the unpaid offers below by having more information (and requiring less scrolling). These ads aren’t easy to compare with other offers on the SERP – you would need to click through to each link to gather and identify the differences between them. Even better for the top ad, Google has trained its users to click on the first result as a matter of course. This means that buyers using Google don’t typically compare many offers and, therefore, vendors using Google AdWords advertising can raise their prices (and have incentive to pay Google). Note that it is well within Google’s technical capability to change Google Search and Google AdWords so that we could easily compare many offers to each other but that Google has no incentive to do so. They would rather give the vendor a temporary monopoly and vendor surplus so that the vendor will pay Google.

Consider it as a game for vendors. Imagine a game in which you can pay a dollar and get $100 back in return (which is $99 for free). How many times do you want to play that game? An infinite number of times.

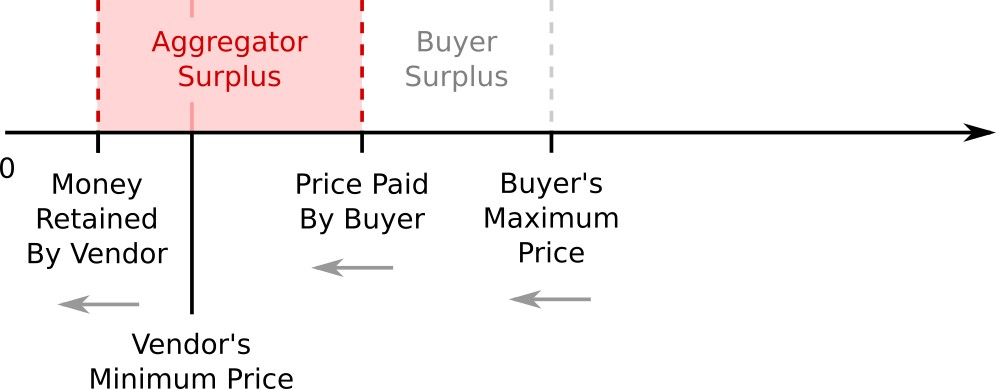

That’s not the end of the story, however, there are many vendors who are interested in playing that game (to obtain free money). As the aggregator attracts more vendors they can take almost all of the induced surplus back by maximizing competition between those vendors to pay the aggregator (until they pay so much that there is no vendor surplus left, only an aggregator surplus):

To put all of this another way, what the aggregators using this strategy are doing are manipulating buyers and vendors so that:

This is the strategy used by all map types which do not rely on discounting (increasing the consumer surplus) to attract attention of buyers:

- attention soaks such as Facebook (who capture our attention to social and informational offers),

- distorted maps such as Google Search (who capture our attention to unpaid commercial offers), and

- some constrained maps (notably shopping malls, who capture our attention to a shopping experience rather than to discounted commercial offers).

The only way that (some) vendors can win at this game (and retain some of the producer surplus) is for the value of each click or impression to be unknown (such that there is undervalued advertising space that vendors with knowledge and skill can identify and purchase). It’s not surprising, then, that we see aggregators taking significant effort to:

- identify and publish the value of their advertising, and

- maximize the number of vendors who use the map (and, therefore, compete to purchase that advertising).

Aggregators claim – and may even believe – that they do these things in the name of fairness and inclusion but the reality is that they’re taking all of the money off the table.

2. Increasing the consumer surplus (and taking vendors’ efficiency)

Other constrained maps (Amazon, Wal-Mart, supermarkets, etc.) attract consumer attention by lowering many prices (relative to other maps) and, therefore, increasing the consumer surplus for buyers who purchase through their map.

To understand how this works, consider an aggregator (e.g. a supermarket) which is making a handy profit from the products it sells:

A new aggregator can attract attention away from incumbents like this by being more efficient than (reducing their costs relative to) other aggregators. This allows them to lower the cost for buyers (attracting their attention) while preserving the vendor surplus *and* giving their vendors an increased volume in sales. This is critical, because new aggregators are relatively powerless compared to established vendors (such as big name manufacturers) who must be kept happy (or they will pull their products from the aggregators and it will fail to attract buyers who want those products):

As other aggregators imitate the innovations of the new aggregator, buyers now expect lower prices and the aggregator must reduce prices further to compete. Now, however, the aggregator has a great deal more buyer attention and the power dynamic with vendors has shifted. The vendors who have become addicted to the high sales volume can no longer afford to go elsewhere (and the aggregator is very happy to threaten them with exclusion from their map). This time, it’s the vendor’s surplus (not the aggregator’s) which is trimmed.

This can happen in two distinct ways – the vendor can be forced to:

- continually reduce their prices, and/or

- bear the aggregator’s costs and risks (by providing credit to the aggregator and paying slotting fees, promotional fees, shrinkage recovery, transport costs, the cost of aggregator-mandated discounts, etc.).

Either way, the vendor is now beginning to feel pressure from the aggregator:

This continues until the aggregator is so powerful that they can force the vendor to have no vendor surplus at all (on threat of exclusion from the map):

Or to put it a different way:

It doesn’t stop there, however – the aggregator can then force the vendor is to go beyond their minimum price:

At this point the vendor must innovate to reduce their costs or go out of business. But unlike vendors in a free market (whose innovation and increased efficiency gives them an increased vendor surplus), these vendors are innovating to preserve the aggregator’s surplus. The aggregator is taking their efficiency as well as their surplus. And it can become much worse than that.

Taking our opportunities

When the vendor is unwilling and/or unable to continue lowering their prices (or the aggregator can otherwise obtain higher margins), the aggregator, who has complete control over their map, can replace them with a competitor or with their own product or service:

Amazon gained our attention by helping people sell their products, but is aggressively expanding its own range of private label brands (sometimes by copying its own sellers) and directs our attention to them. Google gained attention by helping us find information and services from other people but now favors its own services and penalizes competitors’. Uber gave a new kind of work to drivers but its goal was always to replace those drivers (“the dude in the car“) with self-driving cars.

Aggregators always start by promising us free money and new opportunities. Their control over their marketplaces (and their commitment to maximizing profits) ensures, however, that they’ll take the money and opportunities back wherever they can.

Then they’ll use their profits and efficiency in information processing to move into the next market and do the same – offer free money and new opportunities until they can take them back.

What we’re witnessing is not a free market – it’s techno-kleptocracy.

Techno-Kleptocracy

Techno-kleptocracy:

- techno from the Greek word techne (τέχνη) meaning ‘craft, skill, trade, art’,

- klepto is the Greek word κλέπτω meaning ‘I steal’, ‘I cheat, ‘I mislead’, ‘I conceal’, and

- cracy from the Greek word krátos (κράτος) meaning ‘might, strength’, or ‘dominion, power’.

Putting that together give us:

techno-kleptocracy: Aggregators using their skill in information processing to take our money, efficiency and opportunity in a misleading and concealed manner by gaining power over buyers’ attention and manipulating their behavior.

The next question, then, is to ask the extent to which aggregators have harmed our economy, society and information.

Next: Collateral Damage